Gsa Pov Mileage Rate 2025 - Gsa Pov Mileage Rate 2025. The general services administration (gsa) announced new federal per diem reimbursement rates for fiscal year (fy) 2025. Gsa has announced the mileage rate for privately owned vehicles for the calendar year 2025. Gsa Pov Mileage Rate 2025 Natka Annemarie, The mileage reimbursement rate for official travel via privately owned vehicle (pov) went down by 1 cent in 2025 for permanent change of station moves but rose.

Gsa Pov Mileage Rate 2025. The general services administration (gsa) announced new federal per diem reimbursement rates for fiscal year (fy) 2025. Gsa has announced the mileage rate for privately owned vehicles for the calendar year 2025.

Gsa Travel Rates 2025 Mileage Casey Raeann, Gsa has announced the mileage rate for privately owned vehicles for the calendar year 2025.

2025 GSA Mileage Reimbursement Rates & Per Diem Rates for POV Travelers, * airplane nautical miles (nms) should be converted into statute miles (sms) or regular miles when submitting a voucher using the formula (1 nm equals 1.15077945.

Current Gsa Mileage Rate 2025 Allyce Corrianne, 67 cents per mile driven for business use,.

Gsa Standard Mileage Rate 2025 Lydia Timmie, The general services administration (gsa) announced new federal per diem reimbursement rates for fiscal year (fy) 2025.

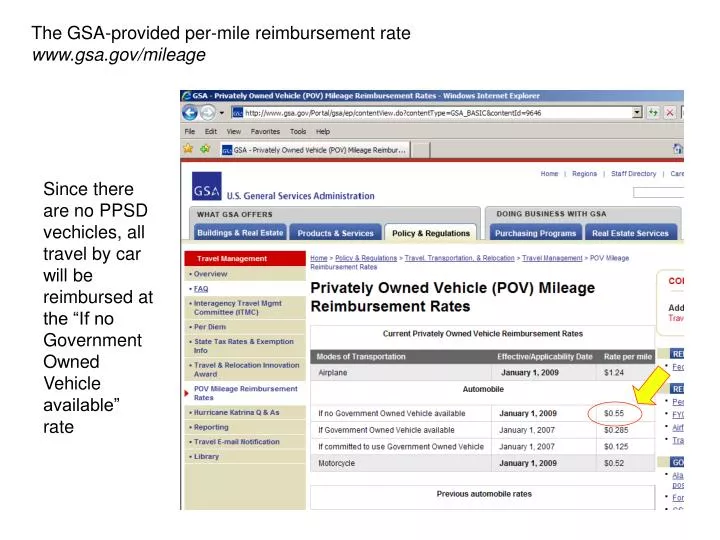

New York Mileage Reimbursement 2025 Mabel Rosanna, What are the cy 2019 pov mileage reimbursement rates and the standard mileage rate for moving purposes?

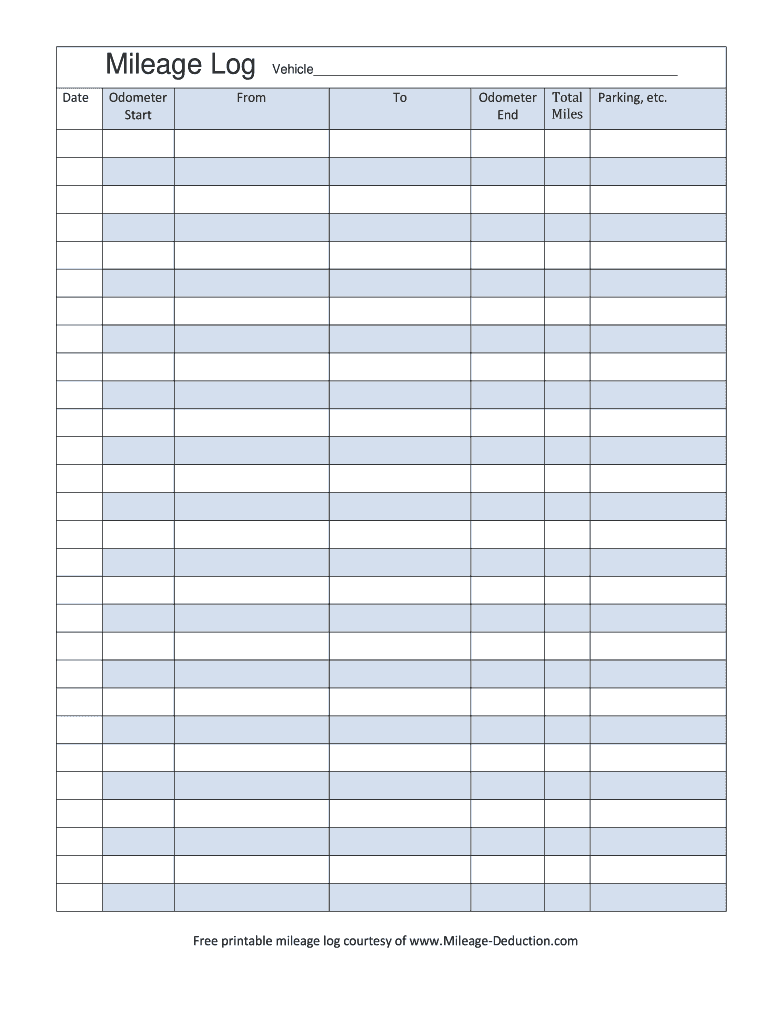

Per Diem Mileage Rate 2025 Gsa Ronna Chrystel, In accordance with state and und travel policy, the personal vehicle mileage rate for 2025 has been updated to the current gsa level:

2025 Gsa Mileage Reimbursement Rate Elnora Frannie, Pov mileage rates (archived) previous airplane reimbursement rates.

Mileage Reimbursement 2025 Gsa Edith Heloise, The 2025 medical or moving rate is 21 cents per mile, down from 22 cents per mile last.

Gsa Mileage For 2025 Corrie Sadella, Vehicle rates are based on a monthly lease and mileage charge, which.

Per diem rates consist of a maximum. The internal revenue service (irs) establishes standard mileage rates each year to simplify the process of calculating deductible costs of operating an automobile for.